top of page

Insuring Resilience

covered roof vents

litigation history

new roof and gutters

non-combustible zone

claims history

hurricane windows

Precision Property Insurance that Motivates Risk Mitigation

Problem

At FutureProof, we offer precise, property-specific insurance solutions that reflect the risk resilience of each exposure. Our unique AI-based technology encourages proactive risk mitigation and can allow us to provide coverage where others may hesitate.

Our Managing General Agent (MGA) works in collaboration with carriers and reinsurers to offer granular pricing, risk selection, and real-time quoting and portfolio management, focusing primarily on Excess & Surplus lines.

FutureProof Insurance Agency is partnered with 20+ insurance carriers, including major national providers:

TECHNOLOGY

Our proprietary, AI-based technology prices cat-loss-relevant factors missing from cat models, which are typically priced via manual, subjective judgments.

Automating the pricing not only allows us to make pricing and underwriting decisions based on data science – it also allows us to provide:

Automated E&S lines quote generation, quote delivery, and portfolio management

Real-time portfolio management for our carrier and reinsurance partners

Instantly bindable pricing for agents

Solution

PRODUCTS

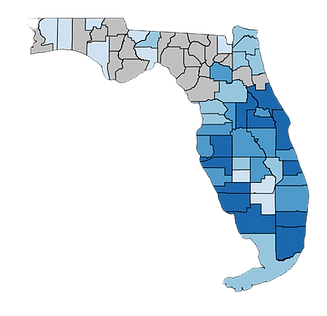

Homeowners Insurance

Customized policies that reflect a home's specific risk profile, offering comprehensive protection.

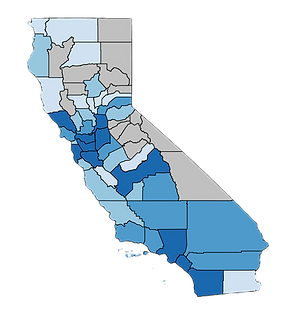

Commercial Property

Solutions designed for businesses, accounting for structural resilience and location-specific risks.

Our proprietary modeling allows us to write in areas affected by hurricane wind, wildfire, severe convective storm, and flood

FUTUREPROOF ADDS VALUE ACROSS THE INSURANCE ECOSYSTEM

Policyholders benefit from coverage at lower prices and incentives for risk mitigation

Brokers use our API for instant quotes and unique pricing to win new business in less time

Carriers and reinsurers benefit from our risk selection and real-time portfolio management

RECENT RECOGNITION

Top 10 (Finalist)

Voted #1 startup of 2021 batch by corporate insurance partners

Top 10 (Finalist)

Top 10 startups to watch in 2023

Contact

CONTACT

We'd love to hear from you.

bottom of page

.png)